The short story:

Trend: All the US indices made new uptrend highs this week. A wide group of cyclicals lead domestically (chart). Ex-US indices, especially Europe, are supportive (chart).

Breadth: Breadth is confirming trend. The number of stocks trading higher on the NYSE reached a new high in October. And more of the SPX is trading above its 50-dma than at any time since May.

Seasonality: Equities are entering what is traditionally its strongest 3-month stretch of the year. And when the summer has been strong (like this year), the winter has been up an even higher percentage of the time. For further discussion, read our recent post.

Volatility: Volatility is low, a set-up for higher equity prices.

Macro: Worldwide PMI data for October was good. The Chicago PMI increased by the most in 30 years. This would seem to indicate rebound in economic growth.

In summary: Taken together, this looks like a lay-up for higher prices over the next several months. For RUT, if the pattern holds (match the colors of the arrows), support should be within the next 2% (chart).

The longer story:

Trend: The trend really is strong. In the past two years, SPX has risen nearly 60%. Nasdaq is up almost 70%. As Ryan Detrick notes, the win streak in SPX is now the third longest of the past 40 years (here).

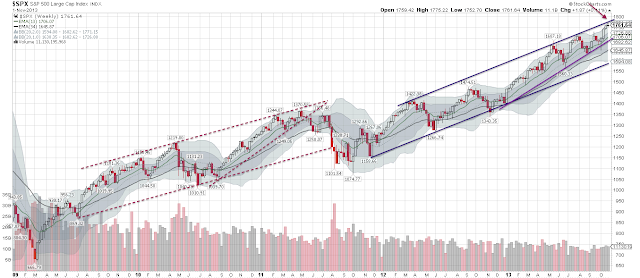

But the trend looks extended. The chart below looks at the spread between the weekly 13-ema and 34-ema. The current streak is longer than the one in 1999. After each of these steep and long runs higher, SPX has declined by more than 15% before continuing higher.

SPX now appears to be up against the top rail of its rising channel where it has previously met resistance. In the chart below, note also the rising wedge as the rate of ascent has increased. Barring a parabolic move, room to continue the steep ascent is close to running out.

Breadth: We'll have more to say about breadth in an upcoming post. Breadth is supportive of higher prices. But it is also extended, like trend.

In the chart below, the number of companies in the SPX above their 50-dma has remained above 20% for 12-months. It's only been longer twice: in 2003 (14-months) and 2007 (13-months). 2003 was the start of a cyclical bull market and 2007 was the end.

Sentiment: In response to a 60-70% run up in prices in the past two years, investors have shifted their assets in a pronounced way.

Fund managers were just 10% overweight equities in late-2011. Last month, they were 60% overweight, the second highest since BAML started tracking in 2001 (post).

According to Barron's, fund managers are bullish by a margin of 8:1 (chart). 89% are bullish large cap stocks (chart).

Retail investors have placed more money in equities in 2013 than in any year since 2000 (article).

In short, equities have gone from out-of-favor to adored.

The chart below looks at the Nasdaq (top panel) and sentiment (bottom panel). As sentiment peaks have been getting higher, the dips in the Nasdaq have been getting shorter and shallower. The price trend in the Nasdaq is going parabolic. Investors have tremendous faith that the current trend will continue higher next year.

The expectations of investment advisors, similarly, have rarely been higher than they are today (more here):

The best returns in equities occur when the outlook appears dire and investors are on the sidelines. That is not the current situation.

Like trend and breadth, sentiment suggests the market is extended.

Real final sales has been growing at 1.6% over the past year (chart).

Likewise, total rail traffic is up just 1.3% YTD over last year.

Employment has been growing at 1.6% over the past two years (chart).

Price inflation, both in the US and abroad, has been falling. PCE in the US is just 1.2% (chart).

Commodity markets are not hinting at growth. On Friday, the CRB index fell to a 4 and 1/2 year low. Commodity prices also fell ahead of prior peaks in SPX (chart).

After a spike higher this summer, treasury yields are back down to 2.6%. TLT has been rising as fast as SPX since the beginning of August whereas, under a growth scenario, they would normally be inversely correlated.

So, while the PMI was good, most macro data has been missing expectations. The Citigroup Economic Surprise Index (CESI) for the US turned negative this week and its close to doing so for the G10 (chart). This matters, as a negative reading corresponds to lower EPS growth and PEs.

In the chart below, prior to 2013, when CESI (blue line) turned negative, SPX headed to its 200-dma (red line). The 200-dma for SPX is currently 9% below Friday's close.

Valuation: As stated, SPX is up nearly 60% in the past two years. Profits per share have grown too. For the SPX, they're up about 17% on a trailing 12-month basis.

That means that the lion's share of the growth in the indices - 70%, in fact - has come from multiple expansion.

As a result, small and mid-cap PEs are at their post-tech bubble top on a forward basis. Ed Yardeni calls their valuation level "nose bleed" (chart).

SPX valuations are also at these highs on a trailing 12-month basis (chart). The difference is that sales growth is now about 1/3 to 1/2 of the rate during the prior period:

Investors are expecting profit growth in the next two years of more than 10% per year. How are actual profits tracking? Nowhere close to 10%.

That means that the lion's share of the growth in the indices - 70%, in fact - has come from multiple expansion.

As a result, small and mid-cap PEs are at their post-tech bubble top on a forward basis. Ed Yardeni calls their valuation level "nose bleed" (chart).

SPX valuations are also at these highs on a trailing 12-month basis (chart). The difference is that sales growth is now about 1/3 to 1/2 of the rate during the prior period:

Investors are expecting profit growth in the next two years of more than 10% per year. How are actual profits tracking? Nowhere close to 10%.

73% of SPX has now reported 3Q financials. EPS growth for the quarter is tracking 3%, well below the 7.2% expected at the start of the quarter on 7/1. Sales is tracking 2.9% growth, which is in-line with the 3% expected.

For the full year, EPS has been revised down to 5.1%. At the start of the year, it was 9.5%. Sales growth is now expected to be 2.0% for the year vs 3.7% on 12/31/12.

What is concerning is this: sales growth of 2% is tracking that of the macro growth figures detailed above. But earnings have grown twice as fast. This means margins have expanded. Why?

According to Stephanie Pomboy, 60% of earnings growth since 2009 has come from reduced interest expense. Heading into next year, the period of rapid rate decline would seem to be over, leaving top line (sales) growth as the primary driver of EPS. That, in turn, implies growth in the 2-4% range.

Under an optimistic scenario, therefore, assuming 4% sales growth, continued high margins (9.5%) and continued high valuations (16.5x), SPX would be expected to appreciate 5% in the next year (green shading). Any deterioration in margins would mean a flat to lower SPX (orange).